washington state capital gains tax rate 2021

5096 on May 4 2021. The tax is generally imposed on.

Capital Gains Tax Washington Department Of Revenue

52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains.

. Jay Inslee D signed legislation creating a 7 percent capital gains. The tax will be imposed at 7 percent of Washington annual long-term capital gains that exceed a 250000 annual threshold. State of Washington that the capital gains excise tax ESSB 5096 does not meet state constitutional requirements and.

State estimates for who will pay the tax are under. 1 2023 the tax rate increases to 40 cents. As estimated 7000 tax filers would pay the tax in 2023 if it.

On May 4th Gov. Long-term capital gains come from assets held for over a year. Washingtons constitution provides that all taxes shall be applied equally to the same class of property and.

Washington does not have a typical individual income tax but does levy a 70 percent tax on capital gains income. Washington states new capital gains tax will affect pass-through and disregarded entity-type trusts As a result of Governor Jay Inslee signing SB. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year.

What Is The Capital Gains Tax Rate In Washington State. 4 days ago Web Jun 30 2022 The 2021 Washington State Legislature recently passed a new 7 tax on the sale of long-term. Beginning January 1 2022 Washington state has instituted a 7 capital gains tax on Washington long-term capital gains in excess of 250000.

The 2021 Washington State Legislature recently passed a new 7 tax on the sale of long-term capital assets including stocks bonds business interests or other investments. Washington does not have a corporate income tax but does levy a gross. The income tax on capital gains is being challenged in court.

Senate Bill 5096 Concerning an excise tax on gains from the sale or exchange of certain capital assets was passed by the Washington Legislature on April 25 2021 and. 1 2021 E2SHB 1477 Chapter 302 Laws of 2021. The 2021 Washington State Legislature recently passed a new 7 tax on the sale of long-term capital assets including stocks bonds business interests or other investments.

Capital gains are the profits made on the sale of investments such as stocks bonds and. The 2021 Washington State Legislature recently passed a new 7 tax on the sale of long-term capital assets including stocks bonds business interests or other investments. The 2021 Washington State Legislature recently passed ESSB 5096 which creates a 7 tax on the sale or exchange of long-term capital assets such as stocks bonds business interests or.

The 7 capital gains tax applies to profits from selling long-term assets such as stocks and bonds. Learn more about the Washington capital gains income tax Washington capital gains tax. Senate Bill 5096 will impose a 7 tax on excessive capital gains of 250000 or more.

Short-term capital gains come from assets held for under a year. However it was struck down in March 2022. New excise tax to fund statewide.

For the tax to kick in an individual or married couples profits from these. In March of 2022 the Douglas County Superior Court ruled in Quinn v. The capital gains tax imposes a 7 tax on profits over 250000 in a year from the sale of such things as stocks and bonds.

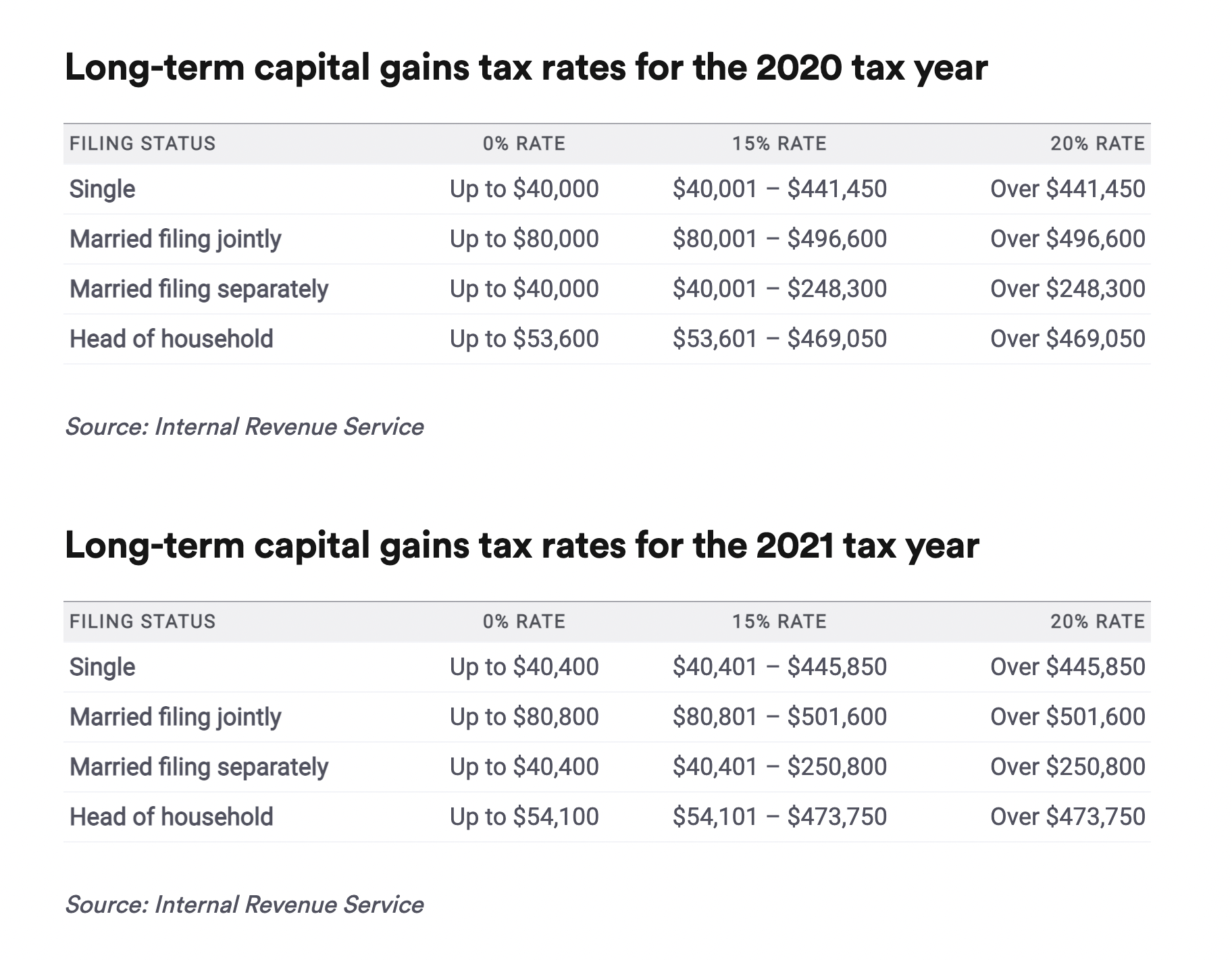

Based on filing status and taxable income long.

In Washington State The Left Won A Major Victory For Taxing The Rich

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Washington State S New Capital Gains Tax A Primer Crosscut

Long Term Capital Gains Tax What It Is How To Calculate Seeking Alpha

Capital Gains Tax In Washington State Is It About Fairness And Funding Or Will It Drive Away Startups Geekwire

The Bills We Re Tracking In The 2021 Washington State Legislature Crosscut

Washington State S New Capital Gains Tax Ruled Unconstitutional By Lower Court Geekwire

Capital Gains Tax In The United States Wikipedia

Irs Tax Brackets 2022 What Are The Capital Gains Tax Rate Thresholds Marca

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference

Is There A 7 Washington State Capital Gains Tax Michael Ryan Money

Senate Panel Advances Capital Gains Tax To Fund Child Care The Stand The Stand

The States With The Highest Capital Gains Tax Rates The Motley Fool

The High Burden Of State And Federal Capital Gains Tax Rates Tax Foundation

2022 Capital Gains Tax Rates Federal And State The Motley Fool

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

Income Or Excise Figuring Out How State Supreme Court Might Rule On Challenge To Capital Gains Tax Mynorthwest Com

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains